July 23, 2015 report

A seemingly obvious way to make the electricity market better may actually make it worse

Restaurants often have their best specials in the middle of the week as a way to increase business on their slowest days. By evening out the flow of customers, carefully timed sale prices can reduce fluctuations in demand. Logically, researchers have wondered if a similar "adaptive pricing strategy" could be used to reduce daily fluctuations in demand in the electricity market, which has become a growing problem with the increased use of fluctuating energy sources, such as wind and solar.

In support of the adaptive pricing strategy, models based on standard economic theory have shown that lowering the price of electricity at off-peak times and communicating the prices through smart meters encourages more consumption at these times in a predictable way. These models suggest that adaptive pricing provides a way to control demand and reduce fluctuations, with significant potential economic advantages.

Now, surprisingly, researchers in a new study have used an alternative model based on econophysics that shows that adaptive pricing has the exact opposite effect: rather than dampen the fluctuations, it amplifies them.

"Our work examines the, at first sight, great idea to use smart electricity meters to dampen fluctuations in the electricity power nets," Stefan Bornholdt at the University of Bremen told Phys.org. "However, we find that under some conditions, consumers with such meters start competing and create a new artificial market which exhibits properties of real markets, such as bubbles and crashes. Thus, instead of dampening out fluctuations, it may create new ones. In this way, interacting smart meters may generate chaos instead of stability."

The reason for amplifying the fluctuations, as Bornholdt and coauthors Sebastian M. Krause and Stefan Börries explain in a paper to be published in Physical Review E, is that changing the price of electricity over time can lead to the emergence of coordinated behavior among consumers.

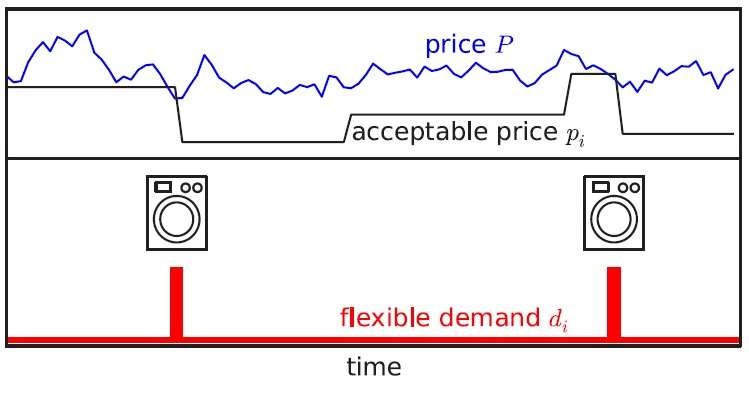

"The coordinated action of consumers in our model stems from our basic needs (of electricity), i.e., the fraction of needs which cannot be postponed indefinitely: washing machines, heaters, AC, etc. Those can wait for a while, however, eventually have to be operated when need has increased (laundry has piled up). We will then even accept a higher electricity price. Indeed, the first washing machines that connect to smart meters allow such a price threshold to be set.

"When laundry piles up, users (or algorithms in advanced machines) can adapt the threshold to a higher allowed price. When the fluctuating price then drops after a while from higher levels, those consumers who postponed their activity will then join the 'happy hour' of cheap electricity, leading to an avalanche of demand (reminding of some crowded bars at happy hour). This is a dynamic phenomenon which econophysics models, but not standard economic models, can represent."

The new econophysics model shows that this coordinated "happy hour" behavior may in turn lead to "catastrophic synchronization" in which the actual demand differs by several orders of magnitude from the average amount predicted by the standard economic model. As a result of this phenomenon, it's nearly impossible to predict the demand at any given price, as the demand varies so widely at one price. In sharp contrast with the standard economic model, an equilibrium price at which supply and demand are balanced can never be established. Instead of providing a way to control demand, adaptive pricing may instead send it fluctuating wildly.

So what's the big difference between the two models that leads to such vastly different outcomes? And which one is more accurate?

The main difference, the researchers explain, is that models based on standard economic theory average the behavior of many agents to predict the outcome of price changes. The econophysics model does not use averaging, but instead allows for independent agent behavior and interactions among a large number of agents, which allows collective behavior to emerge.

The question of which model is more accurate is more difficult to answer. It's well-known that real markets often behave differently than standard economic models, which often fail at predicting bubbles and crashes. Models based on similar principles also encounter problems when describing a wide variety of physical phenomena, such as earthquakes, solar flares, and mass extinctions. One thing these systems have in common, however, is the emergence of collective behavior, which suggests that the econophysics models may have an advantage.

More information: Sebastian M. Krause, et al. "Econophysics of adaptive power markets: When a market does not dampen fluctuations but amplifies them." Physical Review E. DOI: 10.1103/PhysRevE.92.012815

Journal information: Physical Review E

© 2015 Phys.org