July 30, 2015 report

Model shows how surge in wealth inequality may be reversed

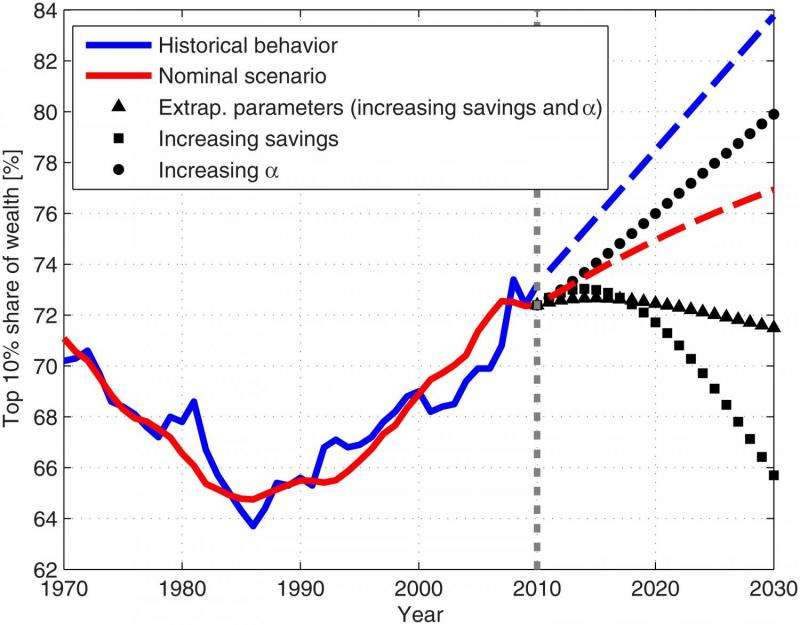

(Phys.org)—For many Americans, the single biggest problem facing the country is the growing wealth inequality. Based on income tax data, wealth inequality in the US has steadily increased since the mid-1980s, with the top 10% of the population currently owning about 73% of the country's wealth. In a new paper published in PLOS ONE, researchers have quantitatively analyzed several of the major factors that affect wealth inequality dynamics, and found that the most crucial factor associated with the recent surge in wealth inequality since the '80s has been the dramatic decrease in personal savings, followed closely by a large increase in the dominance of capital income over labor income.

Taking these findings a step further, the researchers showed in their model that reversing these two trends can prevent and even reverse a further increase in wealth inequality in the future. The researchers hope that the findings will lead to policies that reproduce these results in the real world. But progress in this area may not even have to rely solely on policy changes, as the researchers note that the 2008 financial crisis has caused Americans to save more money, potentially bringing an opportunity to restrain some of the growth in wealth inequality.

The research was led by Eshel Ben-Jacob, who was Professor at the School of Physics & Astronomy at Tel-Aviv University, but passed away unexpectedly before the paper was published. Ben-Jacob was perhaps best known for his work on bacterial self-organization and its applications in complex systems. The other coauthors of the paper are Yonatan Berman, a PhD student, and Yoash Shapira, an adjunct researcher, both at Tel-Aviv University.

Overall, the researchers' model closely reproduces the wealth inequality dynamics in the US from 1930 to 2010, as measured by the share of wealth owned by the top 10% of the population. As the researchers explain in their paper, the usefulness of the new model arises from its ability to quantify the contributions of various factors affecting wealth inequality dynamics, and consequently to serve as a test-bed for predicting the outcomes of future policies.

"The greatest significance of the work is that we succeeded in quantifying the relative effects of different factors contributing to wealth inequality," Berman told Phys.org. "The inequality surge is not due to a single factor. Therefore, in order to understand it better, such a quantification is important. I also think that a very interesting finding is how important personal savings are. Though other elements may be equally important in general, the dramatic decrease in personal savings is probably the single most important ingredient contributing to the increase in wealth inequality in the past 30 years."

Shapira added that, while the dominance of capital income is a very complicated matter that involves the technological change of the past few decades, dealing with the savings issue is relatively easier.

Among the other main results, the researchers' model reveals the complex implications of economic mobility—that is, how easily individuals can change their economic status. On one hand, mobility plays an essential role in restraining wealth inequality, and becomes even more important when the economy becomes dominated by capital income, as is the current trend; when the researchers did not include economic mobility in their model, the model-market correlation dropped dramatically. On the other hand, the researchers also found that further increasing mobility above its current value is likely to have little effect on wealth inequality, suggesting that policies that target improving economic mobility may not be as effective as those that promote increasing personal savings and reducing the dominance of capital income over labor income.

In the future, the researchers plan to investigate how such policies may affect other aspects of the economy besides wealth inequality. For example, an increased savings rate may have the unintended consequence of reducing GDP growth, which tends to increase wealth inequality. Future work will require optimization between these two outcomes.

Other areas of future work will involve investigating the effects of various tax strategies and other additional factors that contribute to wealth inequality dynamics, as well as applying the model to the economies of different countries.

More information: Yonatan Berman, et al. "Modeling the Origin and Possible Control of the Wealth Inequality Surge." PLOS ONE. DOI: 10.1371/journal.pone.0130181

Journal information: PLoS ONE

© 2015 Phys.org